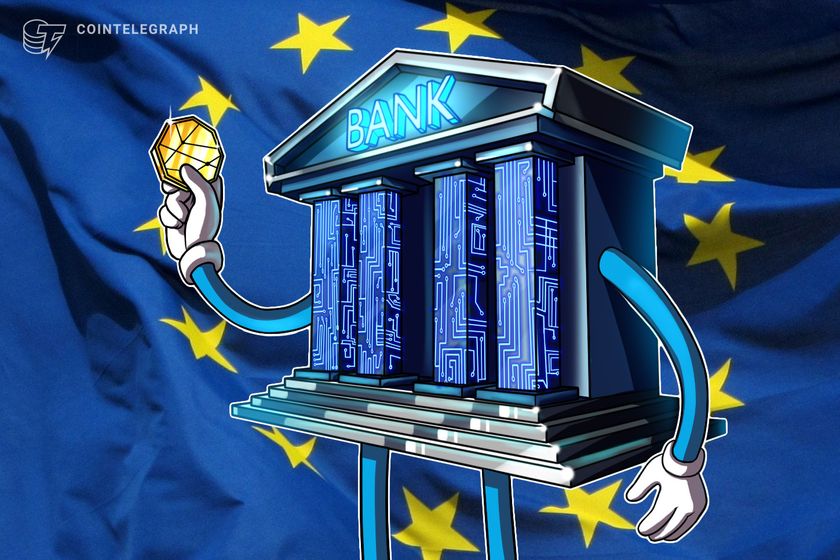

BlackRock’s new European Bitcoin exchange-traded product (ETP) is a major step for Bitcoin’s institutional adoption in Europe, though analysts expect lower inflows than its US counterpart.

The iShares Bitcoin ETP, managed by the world’s largest asset manager, began trading on March 25 on Xetra, Euronext Amsterdam and Euronext Paris.

While the launch marks a significant step in bringing Bitcoin (BTC) exposure to European investors, analysts at Bitfinex said the product is unlikely to match the success of the US-based iShares Bitcoin Trust exchange-traded fund (ETF), which has seen strong demand from institutional and retail investors.

SiShares Bitcoin ETP listings. Source: BlackRock

“The US spot Bitcoin ETFs benefited from pent-up institutional demand, a deep capital market and significant retail investor participation,” Bitfinex analysts told Cointelegraph, adding: